Review rejects hoarding claims

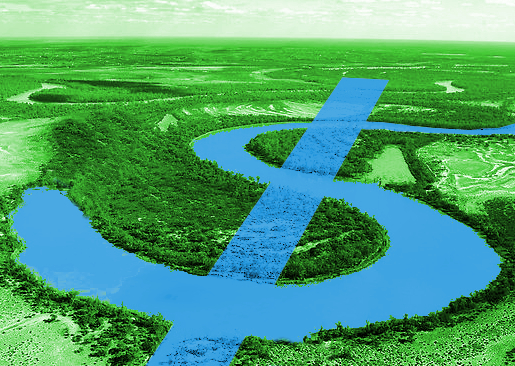

Researchers say water hoarding and and speculation are not driving price rises in the Murray-Darling Basin.

Researchers say water hoarding and and speculation are not driving price rises in the Murray-Darling Basin.

Water hoarding is a strategy to restrict supply, forcing prices up. Price speculation occurs when individuals can influence the market to trigger price rises and gains from trade.

In new research, experts combined three separate analysis techniques to test for hoarding and speculative behaviour, including a benefit-cost assessment of trade gains for irrigation and external investment parties.

“There are a lot of market myths out there right now but in our research we found no evidence of hoarding behaviour in the market volume trends assessed and, therefore, dismissed hoarding as a driver of recent higher prices,” says lead author, Associate Professor Adam Loch from the University of Adelaide’s Centre for Global Food and Resources.

Associate Professor Loch says there is a long history of identifying and analysing speculative bubbles in financial and stock markets but in water markets using those same approaches is challenging due to data limits, differences between water and financial assets, and a lack of clear signals to explain market volatility or severe price hikes.

“Market power is very difficult to assess and test given the unidentified nature of water allocation trades. There is evidence to suggest that some users may control around two per cent of trade volumes when that water is available to them but that does not really provide a basis for market influence,” said Associate Professor Loch.

“There is high likelihood of speculative behaviour in Murray-Darling Basin water markets because the opportunity to make high profits in certain years is clearly apparent.

“But the claim that speculation is solely undertaken by external agents such as superannuation funds does not hold water. It is just as likely for an irrigator with lower total trade costs to be speculating and achieving significant gains in the market.”

But there have been recent price rises.

The experts say that low water supply during drought conditions and higher demand by perennial-crop irrigators who need water to keep their trees alive are more likely driving the recent price rise.

The researchers also say that their results suggest any calls to regulate speculation in water markets would harm farming and irrigation market users.

“Regulating speculation in water markets is unlikely at any rate,” said co-author Dr David Adamson.

“It would be like trying to limit speculation in the housing or share markets.”

A Victorian inquiry recently found that greater water market trade transparency and data improvements would go a long way to answering future concerns about market activity.

“In our view, in the absence of a central pricing and a true water stock market – similar to that of share trading – water brokers are best-placed to play buyers and sellers against one another for trade gain. This was raised a number of times in submissions to the ACCC inquiry,” said Associate Professor Loch.

“If any regulation was to be introduced, attention on water broker trade behaviour and transparency is where it would have the most impact.”

Print

Print